Fountainhead borrowers who received a PPP loan amount less than $150,000 have the convenience of applying for forgiveness using the SBA Paycheck Protection Program Direct Forgiveness portal.

For PPP loans are over $150,000, Fountainhead’s forgiveness platform will be coming soon.

To get answers to your questions, call the SBA Hotline at (877) 552-2692

Monday through Friday, 8 am to 8 pm ET.

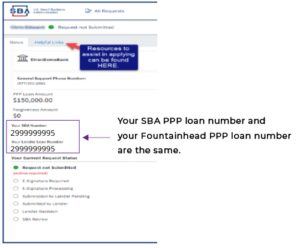

After you register for the portal and begin your application, you will be prompted to search for your SBA PPP loan number by typing in the Tax Identification Number (EIN, SSN or ITIN) you used to apply for your PPP loan and the amount of your loan. Your SBA PPP loan number will be displayed on the left side of the screen.

Learn how to apply on the portal

User Guide (PDF)

SBA webinar explaining how to apply on the portal (video)

SBA PPP Loan Forgiveness FAQs

Read the SBA’s answers to frequently asked questions about PPP loan forgiveness

FAQs

We understand you may have questions about PPP loan forgiveness and have put together the responses below to help keep you informed.

The Small Business Administration and the Department of Treasury establish the guidelines for PPP loan forgiveness. For the latest information, visit the official websites: SBA and U.S. Treasury

Answers to Questions About PPP Loan Forgiveness

- What is loan forgiveness?

If you qualify for loan forgiveness, a portion or the full amount of your loan will not need to be repaid. - How do I determine if my loan can be forgiven?

To be eligible for loan forgiveness, you must spend the funds on payroll and other eligible expenses during the Covered Period. The Covered Period is between 8 weeks and 24 weeks after the date that your loan was disbursed. Learn more about the Covered Period and payroll and other eligible expenses. - How do I get my loan forgiven?

Loan forgiveness is not automatic. You must apply for forgiveness directly with the SBA using their online portal. Click here to apply for forgiveness now. - When do I need to apply for forgiveness?

You have 10 months after the end of your Covered Period to apply for forgiveness. This time is referred to as your Deferral Period. You do not need to make payments of principal or interest during your Deferral Period. (See question #2 to understand Covered Period). - What happens if my loan is not forgiven?

You will be required to repay the amount that is not forgiven. A repayment schedule, specifying a monthly payment amount, will be sent to you. - What is the status of my PPP loan?

You can find the status of your forgiveness application by logging back into the SBA Direct portal. On the bottom left side of the navigation panel is a status box.

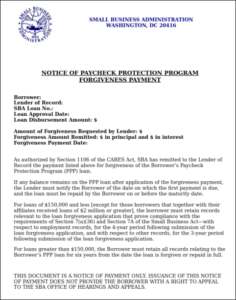

- How can I get a payment/forgiveness confirmation letter that my loan has been approved?

Once an application moves to SBA Decision, the below letter will be available within the Application Portal for Borrowers as confirmation of forgiveness.

- I need help my SSN, Phone number or Email is incorrect.

Please complete the PPP Loan Forgiveness Assistance information online card. - There has been a hold placed on my account how can I get it removed?

Please complete the PPP Loan Forgiveness Assistance information online card.

If you applied for your loan with Womply, you may want to visit their website to review answers to other questions about forgiveness.

Read the SBA’s Borrower FAQ on Direct Forgiveness

© 2021 Fountainhead Commercial Capital